Increased Affordability for Your Clients

Increased Affordability

for Your Clients

LoanDesk provides your clients with the best rates and lending experience possible.

LoanDesk provides your clients with the best rates and lending experience possible.

LoanDesk provides Radius Agents:

LoanDesk provides Radius Agents:

INCREASED PURCHASING POWER

LOAN PROGRAMS TO SAY YES!

VERIFIED PRE-APPROVALS

Want to give your client a boost in affordability?

Want to give your client a boost in affordability?

Refer a Client

Refer a Client

Refer a Client

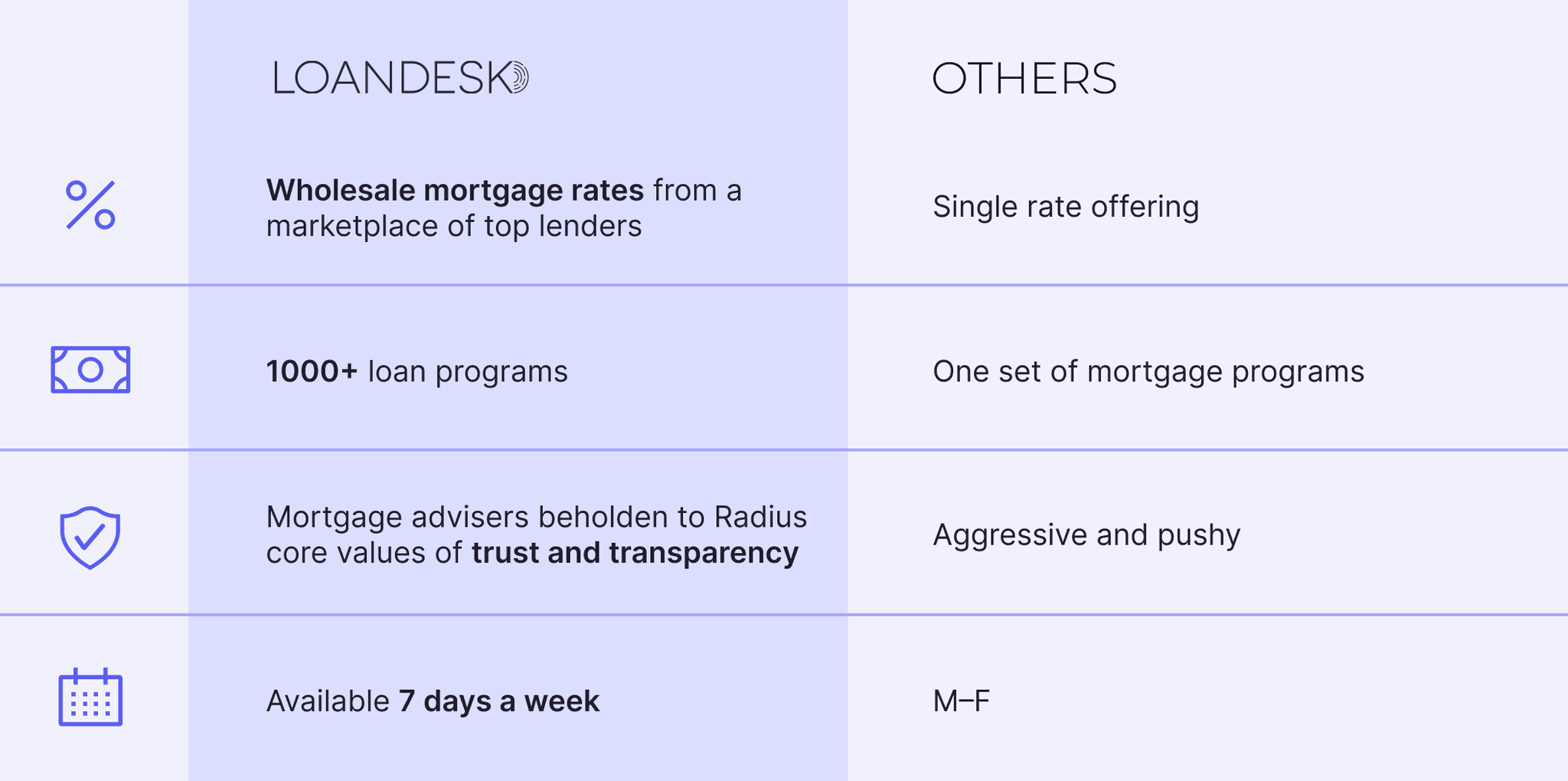

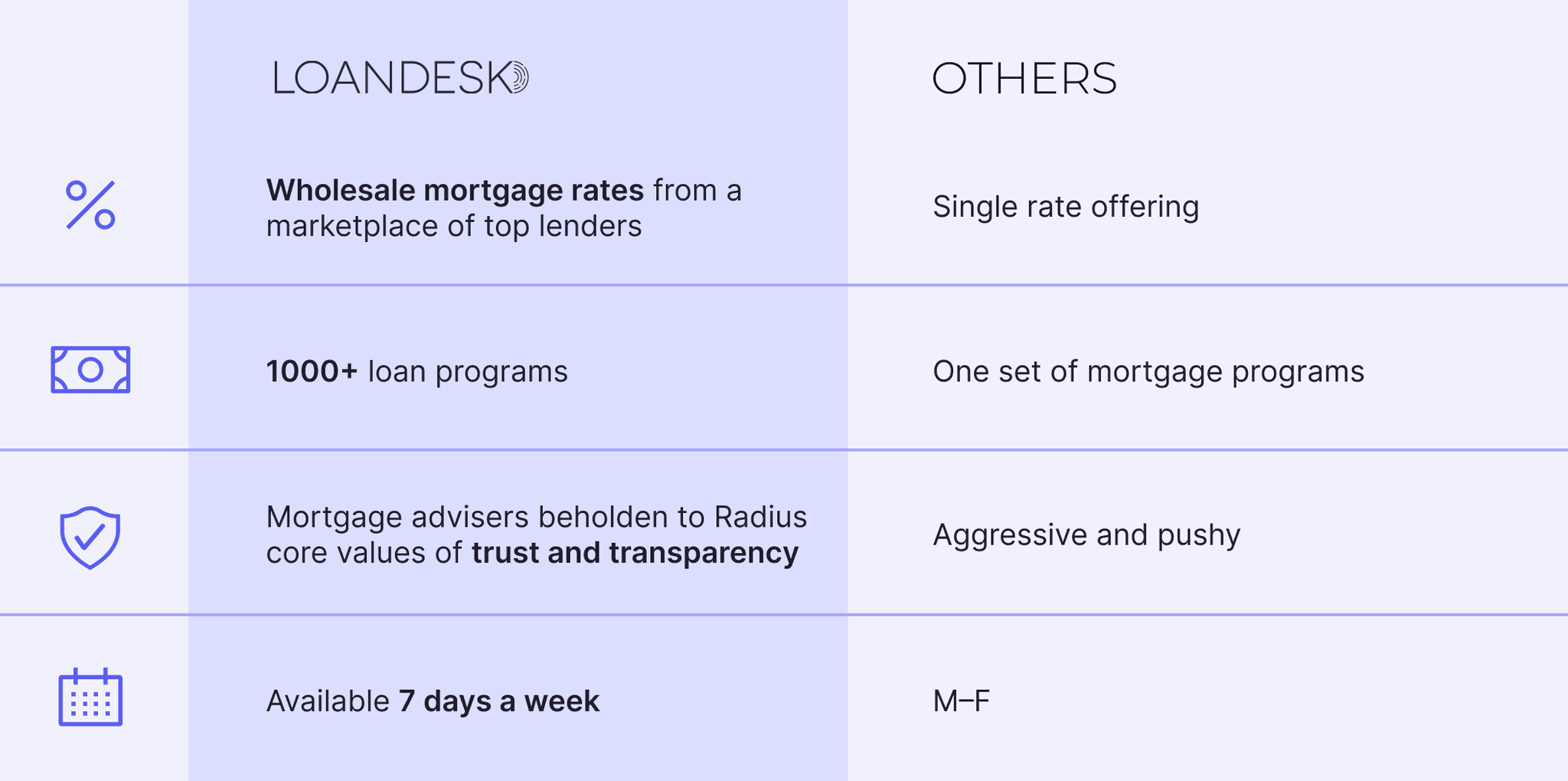

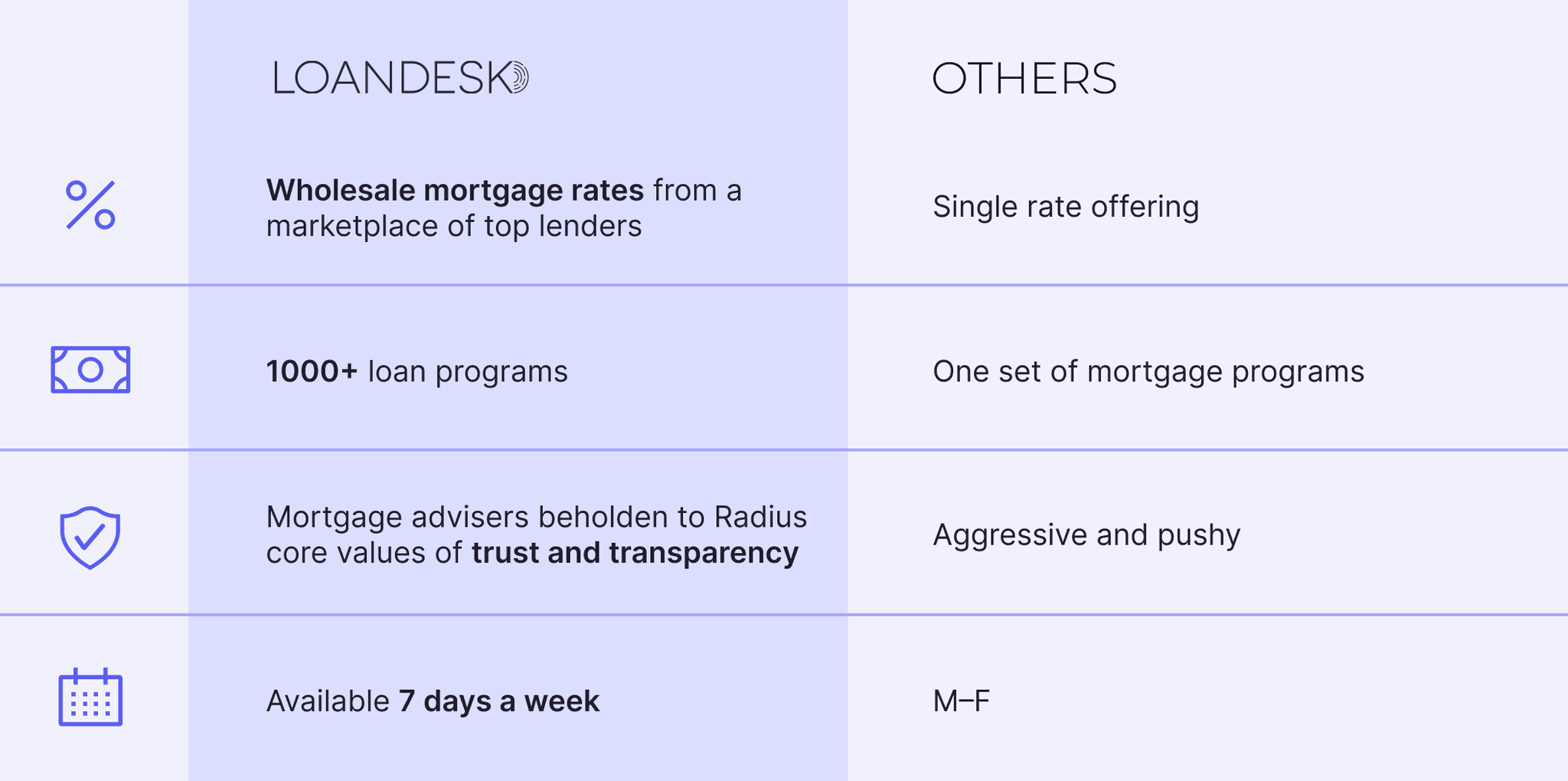

Why LoanDesk?

Why LoanDesk?

Why LoanDesk?

LoanDesk aims to under-cut the average rate by .375%.

LoanDesk aims to under-cut the average rate by .375%.

LoanDesk aims to under-cut the average rate by .375%.

This reduction translates to your clients being able to offer $20,000 more on a property with a lower payment than going to a large lender.

This reduction translates to your clients being able to offer $20,000 more on a property with a lower payment than going to a large lender.

This reduction translates to your clients being able to offer $20,000 more on a property with a lower payment than going to a large lender.

Refer a Client

Refer a Client

Refer a Client

How does LoanDesk offer lower rates?

How does LoanDesk offer lower rates?

Wholesale Rates

Wholesale Rates

LoanDesk receives wholesale rates from large lenders such as Rocket Mortgage, Provident Funding, and Flagstar, a division of of New York Community Bank.

Passing Savings Back

Passing Savings Back

LoanDesk keeps operating costs low to ensure we don’t have to charge your clients more.

LoanDesk Verified

Pre-Approvals

LoanDesk Verified

Pre-Approvals

LoanDesk Verified

Pre-Approvals

What is a verified pre-approval?

What is a verified pre-approval?

What is a verified pre-approval?

Verified pre-approvals are fully underwritten pre-approvals. The actual underwriter is reviewing income, asset, and other documentation of the client to determine their qualification.

Verified pre-approvals are fully underwritten pre-approvals. The actual underwriter is reviewing income, asset, and other documentation of the client to determine their qualification.

Why are verified pre-approvals important?

Why are verified pre-approvals important?

Why are verified pre-approvals important?

Verified pre-approvals involve a more thorough review of financial health – income verification, asset verification, and credit history analysis. This provides a more accurate picture of how much your client can actually afford, giving them a competitive advantage when making an offer.

Verified pre-approvals involve a more thorough review of financial health – income verification, asset verification, and credit history analysis. This provides a more accurate picture of how much your client can actually afford, giving them a competitive advantage when making an offer.

Why does LoanDesk provide verified

pre-approvals?

Why does LoanDesk provide verified

pre-approvals?

Why does LoanDesk provide verified pre-approvals?

LoanDesk strives to provide your clients with a competitive advantage in the home purchasing process.

LoanDesk strives to provide your clients with a competitive advantage in the home purchasing process.

Verified pre-approvals:

Verified pre-approvals:

Verified pre-approvals:

Can give you a negotiation advantage

Create a low stress client experience

Can help with faster closings

Ensure an accurate approval amount

Can give you a negotiation advantage

Create a low stress client experience

Can help with faster closings

Ensure an accurate approval amount

Refer a Client

Refer a Client

Refer a Client

Loan Programs to say YES!

Loan Programs to say YES!

LoanDesk doesn’t just under-cut the market on rates for Conforming, FHA, and VA loans, we’re building a marketplace to help you say “YES!” to your clients.

LoanDesk doesn’t just under-cut the market on rates for Conforming, FHA, and VA loans, we’re building a marketplace to help you say “YES!” to your clients.

Tap into the LoanDesk marketplace to help your clients obtain financing.

Tap into the LoanDesk marketplace to help your clients obtain financing.

LoanDesk loan programs include:

LoanDesk loan programs include:

LoanDesk loan programs include:

One+ | 1% down program | up to $7,000 grant

One+ | 1% down program | up to $7,000 grant

Owner Occupied | No Ratio

Owner Occupied | No Ratio

Bank Statement Loans for Self Employed

Bank Statement Loans for Self Employed

CalHFA down payment assistance

CalHFA down payment assistance

DSCR | No Ratio Loan for Investors

DSCR | No Ratio Loan for Investors

ITIN | Financing for non-U.S. Citizens

ITIN | Financing for non-U.S. Citizens

80-10-10 Piggy-Back Loans

80-10-10 Piggy-Back Loans

HomeReady

HomeReady

HomePossible

HomePossible

Home Equity Loans

Home Equity Loans

Jumbo up to $10M

Jumbo up to $10M

Multi-family Residential 5+ Units

Multi-family Residential 5+ Units

Commercial Financing

Commercial Financing

Condotels

Condotels

Down Payment Assistance

Down Payment Assistance

Loan programs down to 500 credit score

Loan programs down to 500 credit score

Refer a Client

Refer a Client

Refer a Client

Lower Rates without Compromising Service

Lower Rates without Compromising Service

Lower Rates without Compromising Service

TheLoanDesk Standard: By the Numbers

TheLoanDesk Standard: By the Numbers

TheLoanDesk Standard: By the Numbers

60

MINUTES

60

MINUTES

Initial Disclosures

Initial Disclosures

Initial

Disclosures

24

HOURS

24

HOURS

Initial Underwritten

Approval

Initial Underwritten

Approval

Initial

Underwritten

Approval

15

DAYS

15

DAYS

Cleared to Close

Cleared to Close

Cleared

to Close

Let’s help your clients with a a smarter mortgage.

Let’s help your clients with a a smarter mortgage.

Let’s help your clients with a a smarter mortgage.

Refer a Client

Refer a Client

Refer a Client

Have a Client that Needs a Credit Boost?

Have a Client that Needs a Credit Boost?

LoanDesk offers a free Credit Upgrade program that analyzes your client’s credit and determines how to increase this score.

LoanDesk offers a free Credit Upgrade program that analyzes your client’s credit and determines how to increase this score.

How LoanDesk’s Credit Upgrade Program works:

LoanDesk runs a credit simulation that analyzes thousands of data points

LoanDesk provides recommendations on how to increase credit score

LoanDesk provides updated documentation to credit bureau for a Rapid Rescore

LoanDesk runs a credit simulation that analyzes thousands of data points

LoanDesk provides recommendations on how to increase credit score

LoanDesk provides updated documentation to credit bureau for a Rapid Rescore

Refer a Client

Refer a Client

Refer a Client

LoanDesk LLC is a licensed mortgage brokerage headquartered at the address below.

LoanDesk LLC - Headquarters

340 Fremont St., Unit 3703

San Francisco, CA. 94105

LoanDesk LLC is an Equal Opportunity Employer

and supports the Fair Housing Act.

NMLS # 2459500

©2023-2024 Loandesk llc. All rights reserved.

LoanDesk LLC is a licensed mortgage brokerage headquartered at the address below.

LoanDesk LLC - Headquarters

340 Fremont St., Unit 3703

San Francisco, CA. 94105

LoanDesk LLC is an Equal Opportunity Employer and supports the Fair Housing Act.

©2023-2024 Loandesk llc. All rights reserved.

LoanDesk LLC is a licensed mortgage brokerage headquartered at the address below.

LoanDesk LLC - Headquarters

340 Fremont St., Unit 3703

San Francisco, CA. 94105

LoanDesk LLC is an Equal Opportunity Employer and supports the Fair Housing Act.

©2023-2024 Loandesk llc. All rights reserved.

LoanDesk LLC is a licensed mortgage brokerage headquartered at the address below.

LoanDesk LLC - Headquarters

340 Fremont St., Unit 3703

San Francisco, CA. 94105

LoanDesk LLC is an Equal Opportunity Employer

and supports the Fair Housing Act.

NMLS # 2459500

©2023-2024 Loandesk llc. All rights reserved.

LoanDesk LLC is a licensed mortgage brokerage headquartered at the address below.

LoanDesk LLC - Headquarters

340 Fremont St., Unit 3703

San Francisco, CA. 94105

LoanDesk LLC is an Equal Opportunity Employer and supports the Fair Housing Act.

©2023-2024 Loandesk llc. All rights reserved.